Canadian dollar

| Dollar canadien (French) Can$, C$, CA$, CDN$, CAD | |

|---|---|

2011 Frontier series (polymer notes) | |

| ISO 4217 | |

| Code | CAD (numeric: 124) |

| Subunit | 0.01 |

| Unit | |

| Unit | dollar |

| Plural | dollars |

| Symbol | $ |

| Nickname | Loonie, buck (in English) Huard, piastre (pronounced piasse in popular usage) (in French) |

| Denominations | |

| Subunit | |

| 1⁄100 | Cent (in English) and sou (colloquial in French) |

| Plural | |

| Cent | cents |

| Symbol | |

| Cent | ¢ |

| Banknotes | $5, $10, $20, $50, $100 |

| Coins | |

| Freq. used | 5¢, 10¢, 25¢, $1, $2 |

| Rarely used | 1¢ (discontinued, still legal tender), 50¢ (still minted) |

| Demographics | |

| Date of introduction | 1858 |

| Replaced | |

| Official user(s) | Canada |

| Unofficial user(s) | Saint Pierre and Miquelon |

| Issuance | |

| Central bank | Bank of Canada |

| Website | www |

| Printer | Canadian Bank Note Company |

| Website | www |

| Mint | Royal Canadian Mint |

| Website | www |

| Valuation | |

| Inflation | 1.9% |

| Source | Statistics Canada, November 2024 |

| Method | Consumer price index |

| Part of a series on the |

| Economy of Canada |

|---|

|

The Canadian dollar (symbol: $; code: CAD; French: dollar canadien) is the currency of Canada. It is abbreviated with the dollar sign $. There is no standard disambiguating form, but the abbreviations Can$, CA$ and C$ are frequently used for distinction from other dollar-denominated currencies (though C$ remains ambiguous with the Nicaraguan córdoba).[1][2][3][a] It is divided into 100 cents (¢).

Owing to the image of a common loon on its reverse, the dollar coin, and sometimes the unit of currency itself, may be referred to as the loonie by English-speaking Canadians and foreign exchange traders and analysts.[4]

Accounting for approximately two per cent of all global reserves, as of January 2024[update] the Canadian dollar is the fifth-most held reserve currency in the world, behind the US dollar, euro, yen, and sterling.[5] The Canadian dollar is popular with central banks because of Canada's relative economic soundness, the Canadian government's strong sovereign position, and the stability of the country's legal and political systems.[6][7][8][9][10]

History

[edit]Colonial currencies

[edit]The 1850s in Canada were a decade of debate over whether to adopt a £sd-based monetary system or a decimal monetary system based on the US dollar. The British North American provinces, for reasons of practicality in relation to the increasing trade with the neighbouring United States, had a desire to assimilate their currencies with the American unit, but the imperial authorities in London still preferred sterling as the sole currency throughout the British Empire. The British North American provinces nonetheless gradually adopted currencies tied to the American dollar.

| Currency | Dates in use | Value in (pre-decimal) sterling | Value in Canadian dollars |

|---|---|---|---|

| Canadian pound | 1841–1858 | 16s 5.3d | $4 |

| Canadian dollar | 1858–present | 4s 1.3d | $1 |

| New Brunswick dollar | 1860–1867 | ||

| British Columbia dollar | 1865–1871 | ||

| Prince Edward Island dollar | 1871–1873 | ||

| Nova Scotian dollar | 1860–1871 | 4s | $0.973 |

| Newfoundland dollar | 1865–1895 | 4s 2d | $1.014 |

| 1895–1949 | 4s 1.3d | $1 |

Province of Canada

[edit]

In 1841, the Province of Canada adopted a new system based on the Halifax rating. The new Canadian pound was equal to four US dollars (92.88 grains gold), making £1 sterling equal to £1.4s.4d. Canadian. Thus, the new Canadian pound was worth 16 shillings and 5.3 pence sterling.

In 1851, the Parliament of the Province of Canada passed an act for the purposes of introducing a sterling-based unit,[citation needed] with decimal fractional coinage. The idea was that the decimal coins would correspond to exact amounts in relation to the U.S. dollar fractional coinage.

In response to British concerns, in 1853, an act of the Parliament of the Province of Canada introduced the gold standard into the colony,[citation needed] based on both the British gold sovereign and the American gold eagle coins. This gold standard was introduced with the gold sovereign being legal tender at £1 = US$4.86+2⁄3. No coinage was provided for under the 1853 act. Sterling coinage was made legal tender and all other silver coins were demonetized. The British government in principle allowed for a decimal coinage but nevertheless held out the hope that a sterling unit would be chosen under the name of "royal".[citation needed] However, in 1857, the decision was made to introduce a decimal coinage into the Province of Canada in conjunction with the U.S. dollar unit. Hence, when the new decimal coins were introduced in 1858, the colony's currency became aligned with the U.S. currency,[citation needed] although the British gold sovereign continued to remain legal tender at the rate of £1 = Can$4.86+2⁄3 right up until the 1990s. In 1859, Canadian colonial postage stamps were issued with decimal denominations for the first time. In 1861, Canadian postage stamps were issued with the denominations shown in dollars and cents.

Maritime colonies

[edit]In 1860, the colonies of New Brunswick and Nova Scotia followed the Province of Canada in adopting a decimal system based on the U.S. dollar unit.

In 1871, Prince Edward Island went decimal within the U.S. dollar unit and introduced coins in the denomination of 1 cent. However, the currency of Prince Edward Island was absorbed into the Canadian system shortly afterwards, when Prince Edward Island joined the Dominion of Canada in 1873.

Newfoundland

[edit]Newfoundland went decimal in 1865, but unlike the Province of Canada, New Brunswick, and Nova Scotia, it decided to adopt a unit based on the Spanish dollar rather than on the U.S. dollar, and there was a slight difference between these two units. The U.S. dollar was created in 1792 on the basis of the average weight of a selection of worn Spanish dollars. As such, the Spanish dollar was worth slightly more than the U.S. dollar, and likewise, the Newfoundland dollar, until 1895, was worth slightly more than the Canadian dollar.

British Columbia

[edit]The Colony of British Columbia adopted the British Columbia dollar as its currency in 1865, at par with the Canadian dollar. When British Columbia joined Canada as its sixth province in 1871, the Canadian dollar replaced the British Columbia dollar.

Post-Confederation history

[edit]In 1867, the Province of Canada, New Brunswick, and Nova Scotia united into a federation named Canada. As a result, their respective currencies were merged into a singular Canadian dollar. The Canadian Parliament passed the Uniform Currency Act in April 1871,[11] tying up loose ends as to the currencies of the various provinces and replacing them with a common Canadian dollar.

The gold standard was temporarily abandoned during World War I and definitively abolished on April 10, 1933. At the outbreak of World War II, the exchange rate to the U.S. dollar was fixed at Can$1.10 = US$1.00. This was changed to parity in 1946. In 1949, sterling was devalued and Canada followed, returning to a peg of Can$1.10 = US$1.00. However, Canada allowed its dollar to float in 1950, whereupon the currency rose to a slight premium over the U.S. dollar for the next decade. But the Canadian dollar fell sharply after 1960 before it was again pegged in 1962 at Can$1.00 = US$0.925. This was sometimes pejoratively referred to as the "Diefenbuck" or the "Diefendollar", after the then Prime Minister, John Diefenbaker. This peg lasted until 1970, with the currency's value being floated since then.

Terminology

[edit]

Canadian English, similar to American English, used the slang term "buck" for a former paper dollar. The Canadian origin of this term derives from a coin struck by the Hudson's Bay Company during the 17th century with a value equal to the pelt of a male beaver – a "buck".[12] Because of the appearance of the common loon on the back of the $1 coin that replaced the dollar bill in 1987, the word loonie was adopted in Canadian parlance to distinguish the Canadian dollar coin from the dollar bill. When the two-dollar coin was introduced in 1996, the derivative word toonie ("two loonies") became the common word for it in Canadian English slang.

In French, the currency is also called le dollar; Canadian French slang terms include piastre or piasse (the original word used in 18th-century French to translate "dollar") and huard (equivalent to loonie, since huard is French for "loon," the bird appearing on the coin). The French pronunciation of cent (pronounced similarly to English as /sɛnt/ or /sɛn/, not like the word for hundred, /sɑ̃/ or /sã/)[13] is generally used for the subdivision; sou is another, informal, term for 1¢. 25¢ coins in Quebec French are often called trente sous ("thirty cents") because of a series of changes in terminology, currencies, and exchange rates. After the British conquest of Canada in 1760, French coins gradually went out of use, and sou became a nickname for the halfpenny, which was similar in value to the French sou. Spanish dollars and U.S. dollars were also in use, and from 1841 to 1858, the exchange rate was fixed at $4 = £1 (or 400¢ = 240d). This made 25¢ equal to 15d, or 30 halfpence (trente sous). After decimalization and the withdrawal of halfpenny coins, the nickname sou began to be used for the 1¢ coin, but the idiom trente sous for 25¢ endured.[14]

Coins

[edit]

Coins are produced by the Royal Canadian Mint's facilities in Winnipeg, Manitoba, and Ottawa, Ontario, in denominations of 5¢ (nickel), 10¢ (dime), 25¢ (quarter), 50¢ (50¢ piece) (though the 50¢ piece is no longer distributed to banks and is only available directly from the mint, therefore seeing very little circulation), $1 (loonie), and $2 (toonie). The last 1¢ coin (penny) to be minted in Canada was struck on May 4, 2012,[15] and distribution of the penny ceased on February 4, 2013.[16] Ever since, the price for a cash transaction is rounded to the nearest five cents. The penny continues to be legal tender, although it is only accepted as payment and is not given back as change.

The standard set of designs has Canadian symbols, usually wildlife, on the reverse, and an effigy of Charles III on the obverse. A large number of pennies, nickels, and dimes are in circulation bearing the effigy of Elizabeth II, and occasionally some depicting George VI can be found. It is also common for American coins to be found among circulation due to the close proximity to the United States and the fact that the sizes and colours of the coins are similar. Commemorative coins with differing reverses are also issued on an irregular basis, most often quarters. 50¢ coins are rarely found in circulation; they are often collected and not regularly used in day-to-day transactions in most provinces.

Coin history

[edit]This section needs additional citations for verification. (January 2017) |

In 1858, bronze 1¢ and 0.925 silver 5¢, 10¢ and 20¢ coins were issued by the Province of Canada. Except for 1¢ coins struck in 1859, no more coins were issued until 1870, when production of the 5¢ and 10¢ was resumed and silver 25¢ and 50¢ were introduced. Between 1908 and 1919, sovereigns (legal tender in Canada for $4.86+2⁄3) were struck in Ottawa with a "C" mintmark.

Canada produced its first gold dollar coins in 1912 in the form of $5 and $10. These coins were produced from 1912 to 1914. The obverse carries an image of King George V and on the reverse is a shield with the arms of the Dominion of Canada. Gold from the Klondike River valley in the Yukon accounts for much of the gold in the coins.

Two years into the coin's production World War I began and production of the coins stopped in favour of tighter control over Canadian gold reserves. Most of the 1914 coins produced never reached circulation at the time and some were stored for more than 75 years until being sold off in 2012. The high quality specimens were sold to the public and the visually unappealing ones were melted.[17]

In 1920, the size of the 1¢ was reduced and the silver fineness of the 5¢, 10¢, 25¢ and 50¢ coins was reduced to 0.800 silver/.200 copper. This composition was maintained for the 10¢, 25¢ and 50¢ piece through 1966, but the debasement of the 5¢ piece continued in 1922 with the silver 5¢ being entirely replaced by a larger nickel coin. In 1942, as a wartime measure, nickel was replaced by tombac in the 5¢ coin, which was changed in shape from round to dodecagonal. Chromium-plated steel was used for the 5¢ in 1944 and 1945 and between 1951 and 1954, after which nickel was readopted. The 5¢ returned to a round shape in 1963.

In 1935, the 0.800 silver voyageur dollar was introduced. Production was maintained through 1967 with the exception of the war years between 1939 and 1945.

In 1967 both 0.800 silver/0.200 copper and, later that year, 0.500 silver/.500 copper 10¢ and 25¢ coins were issued. 1968 saw further debasement: the 0.500 fine silver dimes and quarters were completely replaced by nickel ones mid-year. All 1968 50¢ and $1 coins were reduced in size and coined only in pure nickel. Thus, 1968 marked the last year in which any circulating silver coinage was issued in Canada.

In 1982, the 1¢ coin was changed to dodecagonal, and the 5¢ was further debased to a cupro-nickel alloy. In 1987 a $1 coin struck in aureate-plated nickel was introduced. A bimetallic $2 coin followed in 1996. In 1997, copper-plated zinc replaced bronze in the 1¢, and it returned to a round shape. This was followed, in 2000, by the introduction of even cheaper plated-steel 1¢, 5¢, 10¢, 25¢ and 50¢ coins, with the 1¢ plated in copper and the others plated in cupro-nickel. In 2012, the multi-ply plated-steel technology was introduced for $1 and $2 coins as well. Also in that year mintage of the 1¢ coin ceased and its withdrawal from circulation began in 2013.

Banknotes

[edit]

The first paper money issued in Canada denominated in dollars were British Army bills, issued between 1813 and 1815. Canadian dollar banknotes were later issued by the chartered banks starting in the 1830s, by several pre-Confederation colonial governments (most notably the Province of Canada in 1866), and after confederation, by the Canadian government starting in 1870. Some municipalities also issued notes, most notably depression scrip during the 1930s.[19]

On July 3, 1934,[20][failed verification] with only 10 chartered banks still issuing notes, the Bank of Canada was founded. This new government agency became the sole issuer of all federal notes. In 1935, it issued its first series of notes in denominations of $1, $2, $5, $10, $20, $25, $50, $100, $500 and $1000. The $25 note was a commemorative issue, released to mark the Silver Jubilee of King George V.[21] In 1944, the chartered banks were prohibited from issuing their own currency, with the Royal Bank of Canada and the Bank of Montreal among the last to issue notes.

Significant design changes to the notes have occurred since 1935, with new series introduced in 1937, 1954, 1970, 1986, and 2001. In June 2011, newly designed notes printed on a polymer substrate, as opposed to cotton fibre, were announced; the first of these polymer notes, the $100 bill, began circulation on November 14, 2011, the $50 bill began circulation on March 26, 2012, the $20 denomination began circulation on November 7, 2012, and the $5 and $10 denominations began circulation on November 12, 2013.

Since 1935, all banknotes are printed by the Ottawa-based Canadian Bank Note Company under contract to the Bank of Canada. Previously, a second company, BA International (founded in 1866 as the British American Bank Note Company), shared printing duties. In 2011, BA International announced it would close its banknote printing business and cease printing banknotes at the end of 2012;[22] since then, the Canadian Bank Note Company has been the sole printer of Canadian banknotes.

All banknotes from series prior to the current polymer series are now considered unfit for circulation due to their lacking of any modern security features, such as a metallic stripe.[23] Financial institutions must return the banknotes to the Bank of Canada, which will then destroy them.[23] Individuals may keep the banknotes indefinitely.[24]

Legal tender

[edit]As of January 1, 2021, the $1, $2, $25, $500 and $1000 notes issued by the Bank of Canada are no longer legal tender.[25] All other current and prior Canadian dollar banknotes issued by the Bank of Canada remain as legal tender in Canada. However, commercial transactions may legally be settled in any manner agreed by the parties involved.

Legal tender of Canadian coinage is governed by the Currency Act, which sets out limits of:[26]

- $40 if the denomination is $2 or greater but does not exceed $10;

- $25 if the denomination is $1;

- $10 if the denomination is 10¢ or greater but less than $1;

- $5 if the denomination is 5¢;

- 25¢ if the denomination is 1¢.

Retailers in Canada may refuse bank notes without breaking the law. According to legal guidelines, the method of payment has to be mutually agreed upon by the parties involved with the transactions. For example, stores may refuse $100 banknotes if they feel that would put them at risk of being counterfeit victims; however, official policy suggests that the retailers should evaluate the impact of that approach. In the case that no mutually acceptable form of payment can be found for the tender, the parties involved should seek legal advice.[27]

Canadian dollars, especially coins, are accepted by some businesses in the northernmost cities of the United States and in many Canadian snowbird enclaves, just as U.S. dollars are accepted by some Canadian businesses.[28]

In 2012, Iceland considered adopting the Canadian dollar as a stable alternative to the Icelandic króna.[29][30] Canada was favoured due to its northern geography and similar resource-based economy, in addition to its relative economic stability.[31][32] The Canadian ambassador to Iceland said that Iceland could adopt the currency; although Iceland ultimately decided not to move on with the proposal.[33]

Value

[edit]

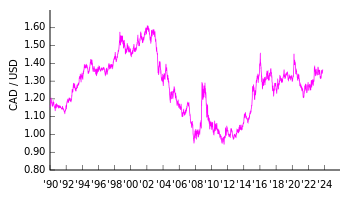

Since 76.7% of Canada's exports go to the U.S., and 53.3% of imports into Canada come from the U.S.,[34] Canadians are interested in the value of their currency mainly against the U.S. dollar. Although domestic concerns arise when the dollar trades much lower than its U.S. counterpart, there is also concern among exporters when the dollar appreciates quickly. A rise in the value of the dollar increases the price of Canadian exports to the U.S. On the other hand, there are advantages to a rising dollar, in that it is cheaper for Canadian industries to purchase foreign material and businesses.

The Bank of Canada currently has no specific target value for the Canadian dollar and has not intervened in foreign exchange markets since 1998.[35] The Bank's official position is that market conditions should determine the worth of the Canadian dollar, although it occasionally makes minor attempts to influence its value.

On world markets, the Canadian dollar historically tended to move in tandem with the U.S. dollar.[36] An apparently rising Canadian dollar (against the U.S. dollar) was decreasing against other international currencies; however, during the rise of the Canadian dollar between 2002 and 2013, it gained value against the U.S. dollar as well as other international currencies. In recent years, dramatic fluctuations in the value of the Canadian dollar have tended to correlate with shifts in oil prices, reflecting the Canadian dollar's status as a petrocurrency owing to Canada's significant oil exports.[37]

The Canadian dollar traded at a record high of US$2.78 in terms of American greenbacks on July 11, 1864, since the latter was inconvertible paper currency.[38] However, the Canadian dollar remained close to par or 1:1 versus the gold or silver US dollar of the time.

Unlike other currencies in the Bretton Woods system, whose values were fixed, the Canadian dollar was allowed to float from 1950 to 1962. Between 1952 and 1960, the Canadian dollar traded at a slight premium over the U.S. dollar, reaching a high of US$1.0614 on August 20, 1957.[38]

The Canadian dollar fell considerably after 1960, and this contributed to Prime Minister John Diefenbaker's defeat in the 1963 election. The Canadian dollar returned to a fixed exchange rate regime in 1962 when its value was set at US$0.925, where it remained until 1970.[38]

As an inflation-fighting measure, the Canadian dollar was allowed to float in 1970. Its value appreciated and it was worth more than the U.S. dollar for part of the 1970s. The high point was on April 25, 1974, when it reached US$1.0443.[39]

The Canadian dollar fell in value against its American counterpart during the technological boom of the 1990s that was centred in the United States, and was traded for as little as US$0.6179 on January 21, 2002, which was an all-time low.[40] Since then, its value against all major currencies rose until 2013, due in part to high prices for commodities (especially oil) that Canada exports.[41]

The Canadian dollar's value against the U.S. dollar rose sharply in 2007 because of the continued strength of the Canadian economy and the U.S. currency's weakness on world markets. During trading on September 20, 2007, it met the U.S. dollar at parity for the first time since November 25, 1976.[42]

Inflation in the value of the Canadian dollar has been fairly low since the 1990s. In 2007 the Canadian dollar rebounded, soaring 23% in value.[38]

On September 28, 2007, the Canadian dollar closed above the U.S. dollar for the first time in 30 years, at US$1.0052.[43] On November 7, 2007, it hit US$1.1024 during trading, a modern-day high[44] after China announced it would diversify its US$1.43 trillion foreign exchange reserve away from the U.S. dollar. By November 30, however, the Canadian dollar was once again at par with the U.S. dollar, and on December 4, the dollar had retreated back to US$0.98, through a cut in interest rates made by the Bank of Canada due to concerns about exports to the U.S.

Due to its soaring value and new record highs at the time, the Canadian dollar was named the Canadian Newsmaker of the Year for 2007 by the Canadian edition of Time magazine.[45]

Since the late 2000s, the Canadian dollar has been valued at levels comparable to the years before its swift rise in 2007. For most of the 2010s, the exchange rate of Canadian to US dollars was approximately US$0.70 to Can$1.00.[46]

Reserve currency

[edit]| Currency | ISO 4217 code |

Symbol or Abbrev.[48] |

Proportion of daily volume | Change (2019–2022) | |

|---|---|---|---|---|---|

| April 2019 | April 2022 | ||||

| U.S. dollar | USD | $, US$ | 88.3% | 88.5% | |

| Euro | EUR | € | 32.3% | 30.5% | |

| Japanese yen | JPY | ¥, 円 | 16.8% | 16.7% | |

| Sterling | GBP | £ | 12.8% | 12.9% | |

| Renminbi | CNY | ¥, 元 | 4.3% | 7.0% | |

| Australian dollar | AUD | $, A$ | 6.8% | 6.4% | |

| Canadian dollar | CAD | $, Can$ | 5.0% | 6.2% | |

| Swiss franc | CHF | Fr., fr. | 4.9% | 5.2% | |

| Hong Kong dollar | HKD | $, HK$, 元 | 3.5% | 2.6% | |

| Singapore dollar | SGD | $, S$ | 1.8% | 2.4% | |

| Swedish krona | SEK | kr, Skr | 2.0% | 2.2% | |

| South Korean won | KRW | ₩, 원 | 2.0% | 1.9% | |

| Norwegian krone | NOK | kr, Nkr | 1.8% | 1.7% | |

| New Zealand dollar | NZD | $, $NZ | 2.1% | 1.7% | |

| Indian rupee | INR | ₹ | 1.7% | 1.6% | |

| Mexican peso | MXN | $, Mex$ | 1.7% | 1.5% | |

| New Taiwan dollar | TWD | $, NT$, 圓 | 0.9% | 1.1% | |

| South African rand | ZAR | R | 1.1% | 1.0% | |

| Brazilian real | BRL | R$ | 1.1% | 0.9% | |

| Danish krone | DKK | kr., DKr | 0.6% | 0.7% | |

| Polish złoty | PLN | zł, Zl | 0.6% | 0.7% | |

| Thai baht | THB | ฿, B | 0.5% | 0.4% | |

| Israeli new shekel | ILS | ₪, NIS | 0.3% | 0.4% | |

| Indonesian rupiah | IDR | Rp | 0.4% | 0.4% | |

| Czech koruna | CZK | Kč, CZK | 0.4% | 0.4% | |

| UAE dirham | AED | د.إ, Dh(s) | 0.2% | 0.4% | |

| Turkish lira | TRY | ₺, TL | 1.1% | 0.4% | |

| Hungarian forint | HUF | Ft | 0.4% | 0.3% | |

| Chilean peso | CLP | $, Ch$ | 0.3% | 0.3% | |

| Saudi riyal | SAR | ﷼, SRl(s) | 0.2% | 0.2% | |

| Philippine peso | PHP | ₱ | 0.3% | 0.2% | |

| Malaysian ringgit | MYR | RM | 0.2% | 0.2% | |

| Colombian peso | COP | $, Col$ | 0.2% | 0.2% | |

| Russian ruble | RUB | ₽, руб | 1.1% | 0.2% | |

| Romanian leu | RON | —, leu | 0.1% | 0.1% | |

| Peruvian sol | PEN | S/ | 0.1% | 0.1% | |

| Other currencies | 2.0% | 2.4% | |||

| Total | 200.0% | 200.0% | |||

A number of central banks (and commercial banks) keep Canadian dollars as a reserve currency. The Canadian dollar is considered to be a benchmark currency.[citation needed]

In the economy of the Americas, the Canadian dollar plays a similar role to that of the Australian dollar (AUD) in the Asia-Pacific region. The Canadian dollar (as a regional reserve currency for banking) has been an important part of the British, French and Dutch Caribbean states' economies and finance systems since the 1950s. The Canadian dollar is held by many central banks in Central and South America as well.[49][citation needed]

By observing how the Canadian dollar behaves against the U.S. dollar, foreign exchange economists can indirectly observe internal behaviours and patterns in the U.S. economy that could not be seen by direct observation. The Canadian dollar has fully evolved into a global reserve currency only since the 1970s, when it was floated against all other world currencies. Some economists have attributed the rise of importance of the Canadian dollar to the long-term effects of the Nixon Shock that effectively ended the Bretton Woods system of global finance.[50]

Exchange rates

[edit]

| Current CAD exchange rates | |

|---|---|

| From Google Finance: | AUD CHF CNY EUR GBP HKD JPY USD |

| From Yahoo! Finance: | AUD CHF CNY EUR GBP HKD JPY USD |

| From XE.com: | AUD CHF CNY EUR GBP HKD JPY USD |

| From OANDA: | AUD CHF CNY EUR GBP HKD JPY USD |

See also

[edit]- Economy of Canada

- List of countries by leading trade partners

- List of the largest trading partners of Canada

Notes

[edit]- ^ There are various common abbreviations to distinguish the Canadian dollar from others: while the ISO 4217 currency code "CAD" (a three-character code without monetary symbols) is common, no single system is universally accepted. The World Bank, Editing Canadian English and The Canadian Style guide all indicate "Can$". "C$" is the symbol for the Nicaraguan córdoba, and as such is discouraged by The Canadian Style guide. Editing Canadian English also indicates "CDN$"; both style guides note the ISO code.

References

[edit]Citations

[edit]- ^ "Canadian dollar (Symbol) (Linguistic recommendation from the Translation Bureau)". Translation Bureau. October 15, 2015. Archived from the original on February 19, 2020. Retrieved October 2, 2021.

In an English document, when you need to specify the type of dollar (Canadian, American, Australian, etc.), the Translation Bureau recommends using the symbol Can$ to represent the Canadian dollar. ... The shorter variant C$ is another symbol frequently used for the Canadian dollar. However, the Translation Bureau does not recommend this symbol, since it has a slight risk of ambiguity: it is also used to represent the Nicaraguan córdoba oro, Brazilian cruzeiro and occasionally the Cayman Islands dollar as well.

- ^ "World Bank Editorial Style Guide 2020 – page 135" (PDF). openknowledge.worldbank.org. Retrieved August 27, 2022.

- ^ "Currencies Facts > Major Currencies > Canadian Dollar – Canadian Dollar Currency". Oanda. Retrieved April 22, 2024.

- ^ "Report on Business: Great time for European vacation as loonie hits record high against euro". The Globe and Mail. July 12, 2012. Archived from the original on May 5, 2018. Retrieved November 9, 2014.

- ^ "Currency Composition of Official Foreign Exchange Reserves (COFER)". International Monetary Fund. 2024. Retrieved September 1, 2024.

- ^ "Canada's resilience has foreign central banks loading up on loonies". The Globe and Mail. May 13, 2014. Archived from the original on March 5, 2016. Retrieved November 9, 2014.

- ^ "What's lifting the high-flying loonie?". The Globe and Mail. September 19, 2012. Archived from the original on March 4, 2016. Retrieved November 9, 2014.

- ^ "Seven reasons to invest in Canada now". The Globe and Mail. March 11, 2013. Archived from the original on January 21, 2017. Retrieved November 9, 2014.

- ^ "China likely sitting on billions of Canadian dollars". The Globe and Mail. October 2, 2015. Archived from the original on June 15, 2018. Retrieved January 13, 2016.

- ^ "Why a world in turmoil is still parking its cash in Canada — lots of cash". The National Post. December 31, 2015. Archived from the original on May 12, 2018. Retrieved January 13, 2016.

- ^ "1871 – Uniform Currency Act". Canadian Economy Online, Government of Canada. Archived from the original on February 21, 2008. Retrieved February 18, 2008.

- ^ Heritage, Canadian (December 14, 2017). "Official symbols of Canada - Canada.ca". www.canada.ca. Archived from the original on December 24, 2019. Retrieved April 25, 2018.

- ^ Guilloton, Noëlle; Cajolet-Laganière, Hélène (2005). Le français au bureau. Les publications du Québec. p. 467. ISBN 2-551-19684-1.

- ^ Farid, Frédéric (September 26, 2008). "Pourquoi trente sous = 25 cents ?". Archived from the original on October 23, 2017. Retrieved October 6, 2010.

- ^ "Canada's Last Penny minted". CBC. May 4, 2012. Archived from the original on September 4, 2012. Retrieved May 28, 2012.

- ^ "Canadian Penny Discontinued: Feb. 4 Marks The Official End Of Canada's Copper-Coloured Coin". Huffington Post Canada. February 1, 2013. Archived from the original on July 20, 2013. Retrieved June 28, 2013.

- ^ "A National Treasure Resurfaces as the Royal Canadian Mint Offers Rare Opportunity to Own Canada's First Gold Coins, Crafted With Pride From 1912-1914". www.mint.ca. Archived from the original on December 22, 2015. Retrieved December 15, 2015.

- ^ Size, John (May 4, 2012). "Last Canadian penny on its way to Ottawa currency museum". CTV News. Retrieved April 17, 2024.

- ^ Khakase, Sandeip (2017). Demonetisation: Monumental Blunder or Masterstroke. People's Literature. ISBN 978-81-932525-5-0.

- ^ Linzmayer, Owen. "Canada". The Banknote Book. San Francisco, CA: CDN Publishing. Archived from the original on August 29, 2012. Retrieved December 19, 2023.

- ^ "1935: The First Series". www.bankofcanadamuseum.ca. Retrieved May 26, 2022.

- ^ "G&D to Shutter Banknote Printing in Ottawa". PrintAction. December 2, 2011. Archived from the original on December 20, 2013. Retrieved January 28, 2013.

- ^ a b "Unfit Bank Notes" (PDF). bankofcanada.ca. Bank of Canada. October 2012. Archived (PDF) from the original on January 27, 2020. Retrieved January 15, 2020.

- ^ CBC News 2000.

- ^ "About legal tender". www.bankofcanada.ca. Archived from the original on August 13, 2021. Retrieved August 19, 2021.

- ^ "BILL C-41 – As passed by the House of Commons". Parliament of Canada. Archived from the original on May 25, 2011. Retrieved December 31, 2008.

- ^ "Currency Counterfeiting – FAQ". Royal Canadian Mounted Police. Archived from the original on February 15, 2008. Retrieved February 17, 2008.

- ^ "6 US Destinations That Will Accept Canadian Money Without Converting It". NARCITY. March 14, 2016. Archived from the original on February 12, 2019. Retrieved February 11, 2019.

- ^ Mckenna, Barrie (March 2, 2012). "Canadian envoy to Iceland sparks loonie controversy". The Globe and Mail. Archived from the original on March 4, 2012. Retrieved March 4, 2012.

- ^ Hopper, Tristin (May 15, 2012). "If Iceland adopts the loonie, Greenland could soon follow: economist". The National Post. Retrieved May 15, 2012.

- ^ McKenna, Barrie (March 2, 2012). "Canadian envoy to Iceland sparks loonie controversy". The Globe and Mail. Archived from the original on March 2, 2012. Retrieved March 3, 2012.

- ^ "Canada ready to discuss letting Iceland use its dollar". icenews.is. Archived from the original on March 4, 2012. Retrieved March 8, 2012.

- ^ Babad, Michael (September 24, 2012). "Canadian dollar a 'poor choice' for Iceland, central bank says". The Globe and Mail. Archived from the original on January 5, 2013. Retrieved November 24, 2012.

- ^ Central Intelligence Agency. "The World Factbook – Canada". Archived from the original on September 22, 2021. Retrieved June 16, 2016.

- ^ "Understanding exchange rates". www.bankofcanada.ca. Archived from the original on August 30, 2020. Retrieved October 8, 2020.

- ^ "XE Currency Charts: USD to CAD". XE.com. Archived from the original on December 5, 2017. Retrieved February 11, 2019.

- ^ "On the Canadian dollar and the oil prices". March 12, 2013. Archived from the original on February 22, 2014. Retrieved March 16, 2013.

- ^ a b c d "Canadian Dollar History". ExchangeRate.com. Archived from the original on February 28, 2020. Retrieved May 4, 2020.

- ^ Powell, James (2005). A History of the Canadian Dollar. Bank of Canada. ISBN 0-660-19571-2.

- ^ oanda.com. "Historical exchange rate of CAD to USD from December 21, 2001 to February 21, 2002". Archived from the original on July 11, 2007. Retrieved March 14, 2007.

- ^ "How & Why Oil Impacts The Canadian Dollar". Investopedia. October 16, 2018. Archived from the original on February 12, 2019. Retrieved February 11, 2019.

- ^ "Topsy-turvy world last time loonie was on par with greenback". Canadian Press. September 20, 2007. Archived from the original on June 9, 2007. Retrieved September 21, 2007.

- ^ "Loonie closes above parity with greenback". ctv.ca. Archived from the original (.html) on October 12, 2007. Retrieved September 28, 2007.

- ^ Grant, Tavia (November 7, 2007). "China sends loonie flying above $1.10". The Globe and Mail. Archived from the original on December 1, 2008. Retrieved November 7, 2007.

- ^ "Lofty loonie named Time's top Canadian newsmaker". Cbc.ca. December 20, 2007. Archived from the original on June 5, 2008. Retrieved March 2, 2011.

- ^ "XE: CAD / USD Currency Chart. Canadian Dollar to US Dollar Rates". www.xe.com. Archived from the original on January 10, 2020. Retrieved October 8, 2020.

- ^ Triennial Central Bank Survey Foreign exchange turnover in April 2022 (PDF) (Report). Bank for International Settlements. October 27, 2022. p. 12. Archived (PDF) from the original on October 27, 2022.

- ^ "Currency Units". Editorial Style Guide (PDF). World Bank Publications. p. 134–139.

- ^ "Canadian dollar gaining ground as reserve currency, IMF data shows". ca.news.yahoo.com. October 2, 2014. Archived from the original on May 9, 2021. Retrieved October 8, 2020.

- ^ "A Look At The History Of The Canadian Dollar". KnightsBridgeFX. Archived from the original on February 12, 2019. Retrieved February 11, 2019.

Sources

[edit]- Krause, Chester L.; Clifford Mishler (1991). Standard Catalog of World Coins: 1801–1991 (18th ed.). Krause Publications. ISBN 0873411501.

- Pick, Albert (1994). Bruce, Colin R. II; Shafer, Neil (eds.). Standard Catalog of World Paper Money: General Issues (7th ed.). Krause Publications. ISBN 0-87341-207-9.

- Pick, Albert (1990). Bruce, Colin R. II; Shafer, Neil (eds.). Standard Catalog of World Paper Money: Specialized Issues (6th ed.). Krause Publications. ISBN 0-87341-149-8.

- "Bank of Canada kills $1000 bill". CBC News. September 26, 2000. Retrieved March 2, 2014.